- No products in the cart.

Stikii Helps”Stomp” Out Shoe Tax

Have you ever wondered why a pair of shoes that seems to cost the manufacturer so little to produce, costs YOU, the consumer, so much to purchase? There are various “hidden” costs placed on shoes sold in the United States, for example:

A pair of shoes costs a footwear producer $20.00 to manufacture at their plant.

There are $7.40 in duties/tariffs/taxes placed on the product BEFORE it even comes to a U.S. shelf~

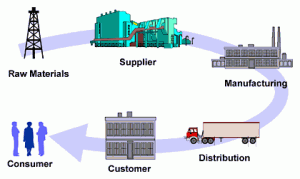

Of course, the shipping company probably wants to get paid for their services, along with the trucking company, the warehouse that stores the goods, the sales team promoting the shoes and of course, the store that physically sells the shoes also needs to make a profit on the sale. Thus, the $20.00 manufacture price + $7.40 trade fees bring the initial cost to $27.40. After this number is determined, the price must be raised to cover the costs of each man on the supply chain!

Stikii wants nothing more than to offer its customers the best product, at the most affordable price, but tariffs make this extremely difficult! So why not get rid of the duties all together, right? These taxes are filled with unnecessary fees, so fighting to repeal the footwear tax imposed in America would directly lower the costs we pay for shoes.

For just about five years, lowering the duties placed on footwear and the United States has been a growing cause. Actions have been taken, such as implementing free trade agreements and targeted duty suspension and elimination bills, but this is not enough! Nearly 99 percent of all footwear sold in the USA is imported, 80 percent of those being from China, but United States footwear companies continue to fork over nearly $2 billion in duties each year. After markups are included at the wholesale and retail levels, this $2 billion translates to a nearly $6 billion tax on hardworking American citizens and their families!

In reaction to this issue, the Affordable Footwear Act (AFA) has been introduced in Congress. In July of 2011, Rep. Lynn Jenkins (of Kansas – District 2) as legislation seeking to end the shoe tax, the high import tariffs on lower-to-moderately-priced and children’s footwear no longer produced in the U.S. This bill would ultimately lower the price of shoes, a commodity that every American must buy, if passed. The purpose/goal of the Affordable Footwear Act of 2011 reads “to suspend temporarily the duty on certain footwear and for other purposes”. Section 2 of the bill, titled “Findings”, states seven discoveries made by congress regarding the issue. Some of these findings include:

– Average collected duties on imported footwear are among the highest of any product sector, totaling approximately $2,000,000,000 during 2010.

– Low- and moderate-income families spend a larger share of their disposable income on footwear than higher-income families.

– The outdoor industry develops innovative and high performance footwear that promoted healthy and active lifestyles through outdoor recreation.

– The duties currently imposed by the United States were set in an era during which high rates of duty were intended to protect production of footwear in the United States.

By focusing on only $700 million of the total $1.9 billion Americans pay over each year in duties, with markups at wholesale and retail levels, this $700 million in cost to the U.S. Treasury actually translates to $2-3 billion in savings for working families. The AFA also takes into consideration the protection of the few domestic footwear manufacturers left within the States’ boundaries. This being said, the AFA is a non-controversial legislation, backed by the entire U.S. footwear industry and many U.S. citizens! Stikii says that it is about time such a bill was brought forward! If approved, the AFA would create a three-year suspension on many of the disproportionately high import tariffs that are imposed on footwear. The bill is temporary so that domestic production can be reevaluated after four years and further adjustments made if necessary.

The current shoe tax imposed on manufacturers consists of outdated, disguised and regressive import duties. This depression-era shoe tax originated in the 1930s to help protect a manufacturing sector that no longer exists today! In the past 2 decades, domestic footwear production here in the USA has all but disappeared. The small handful of footwear manufacturers continuing to produce in the country specialize in niche items differentiated by brand, purpose, and quality. The AFA does not actually apply to those remaining domestic manufacturers, which is why the bill is non-controversial and they do not oppose it. Products addressed by the AFA are not produced in America, but are still subject to the high-fee shoe tax.

The Affordable Footwear Act would serve as a tax relief for low to middle income American families in the form of lower prices on ALL shoes. This initiative is greatly supported by the American Apparel & Footwear Association (AAFA), who has successfully lobbied for the temporary elimination/reduction of duties on U.S. imports on over 30 different types of footwear through what is known as the “Miscellaneous Trade Bill” process. This group has taken on a leadership role in developing and lobbying for this important cause, and have even launched and informational website – www.EndTheShoeTax.org – where consumers can learn more about the taxes they pay on shoes.

Trade officials from various Asian nations are meeting with members of the U.S. government this week in Dallas, Texas to discuss a trade agreement that would reduce tariffs written into the Trans-Pacific Partnership agreement.

This is where we come in! We need to convince congress that repealing these footwear taxes would ultimately better our economy and help out American citizens!! How do we do that you ask? Why we TELL them of course! Stikii is asking for your help to pass the AFA bill. To show your support, we ask that you write a letter or email to congress expressing your opinion on the issue, why it is important to you, and that you are behind them in the fight! Below you will find a sample letter that we invite you to use at your convenience. Simply cut and paste the drafted letter into your email or print it out and send it via snail mail to the addresses provided. If writing your own letter, be sure to mention Stikii!

Your Name

Your Address

Date

Contacts Name

Contacts Address

Dear _____________,

I am writing this letter to show my support for Bill number H.R. 2697: Affordable Footwear Act of 2011. I understand that you are very involved in the actions and outcomes associated with this Bill, and I strongly urge you to keep pushing forward to suspend the duties imposed on footwear in the United States. Thanks to the information provided by Stikii, Inc. (www.stikii.com), I believe that it is time for a change, and that lowering the price of footwear for all Americans is a step toward a better economy and a brighter future. The proposed Bill would ultimately save hard-working Americans $2-3 billion each year. The individual savings provided by the passing of this Bill would be extremely helpful to my family and our loved ones. I genuinely appreciate the role you play in shaping our country and your support of the Affordable Footwear Act.

Respectfully,

Your Name

Send your letters and comments to:

Rep. Lynn Jenkins

2nd District of Kansas

Topeka Office

3550 SW 5th Street

Topeka, KS 66606

Phone: (785) 234-LYNN (5966)

OR

Washington, DC Office

1122 Longworth HOB

Washington, D.C. 20515

Phone: (202) 225-6601

http://lynnjenkins.house.gov/index.cfm?sectionid=209 ß– Visit this site to send letter electronically

_____________________________________________________________________________________

Kurt Courtney

American Apparel & Footwear Association

Director, Government Relations

1601 North Kent Street

Suite 1200

Arlington, VA 22209

P: (703) 797-9039

E: kcourtney@wewear.org

_____________________________________________________________________________________

Email: info@endtheshoetax.org

_____________________________________________________________________________________

Help Stikii help YOU!